Catalyst: DC pensions

DC PENSIONS TECHNICAL UPDATE | SUMMER EDITION

Notes from our editors

The DC pensions landscape is experiencing a period of transformative change driven by landmark legislative reforms.

The Pension Schemes Bill, introduced in June, represents the most significant shake-up to the sector in years. We're seeing a regulatory environment that's becoming increasingly supportive of innovation, with TPR's new Innovation Hub signalling a collaborative approach to solving long-standing challenges. Meanwhile, the Department for Work and Pensions has announced the revival of the Pensions Commission as a long-term measure to giving today’s workers a more secure retirement outlook, and the Government will progress its plan for unused pension funds and death benefits to be included in a person's estate for Inheritance Tax purposes.

The theme of enhanced accountability also runs throughout this quarter's developments, from the revised UK Stewardship Code's shift from process to outcomes, to the FCA's targeted support proposals addressing the advice gap that leaves many savers navigating complex retirement decisions alone. What's particularly encouraging is the focus on practical member outcomes – whether through TPR's push for innovative at-retirement solutions, the updated Retirement Living Standards reflecting changing living arrangements, or the continued progress on pensions dashboards connectivity.

While these changes bring compliance challenges and heightened governance demands, they collectively point toward a future where DC schemes are better equipped to deliver meaningful retirement security for their members.

Pension Schemes Bill: Call for evidence

The Pension Schemes Bill, introduced on 5 June 2025, represents a landmark reform aimed at transforming the UK pensions landscape by promoting consolidation, enhancing saver outcomes, and boosting economic growth through productive investments.

A call for evidence has been launched by the House of Commons Public Bill Committee to gather insights from stakeholders, building on prior consultations such as the Pensions Investment Review. Submissions are invited through to early autumn ahead of the public Bill Committee report, expected on 23 October 2025.

We have provided a further overview of the detail of the Bill that is relevant for DC schemes in our Special Edition of Catalyst.

Key developments and implications

The Bill had its second reading on 7 July 2025, with oral evidence sessions scheduled for 2 September 2025 and a reporting deadline of 23 October 2025. It focuses on consolidating defined contribution (DC) schemes into fewer, larger entities to improve returns and enable investment in high-growth assets, potentially adding £29,000 to average pension pots.

Key measures include mandating value for money assessments, the introduction of a framework for consolidating small, deferred DC pots, facilitating bulk transfers without consent in certain cases, and empowering the Secretary of State to intervene if schemes underinvest in UK assets.

For DC schemes, this aligns with ongoing trends towards master trusts and collective DC models, as seen in the rapid consolidation noted in TPR's 2024 research. Implications include heightened governance demands, with risks of regulatory scrutiny if schemes fail to demonstrate value or adapt to innovation in decumulation strategies. This complements the Mansion House reforms and Autumn Budget 2024 announcements on pension megafunds and inheritance tax changes.

Alongside the Bill, the Pensions Regulator (TPR) has encouraged smaller DC schemes to strongly consider winding up if they are unable to compete effectively with the best schemes in the market. A press release was issued alongside the most recent Compliance and Enforcement Bulletin noting that TPR was increasingly using its enforcement powers to issue fines for non-compliance with the more detailed Value for Members assessment which applies to smaller trust-based DC schemes.

In response to research showing that only 17% of schemes required to complete these assessments had done so, TPR launched a regulatory exercise to ensure compliance and had since issued fines of close to £100,000 in relation to 19 schemes for related governance failings. TPR has therefore urged schemes who either cannot demonstrate good value or who are not complying with their governance obligations to consider whether a transfer to a better-value scheme is in the best interest of their members.

Actions for trustees:

- Submit evidence to the Public Bill Committee as soon as possible, focusing on how the Bill impacts your scheme's governance and investment strategy, to influence final legislation.

- Review your scheme's size and performance against the proposed value for money framework, considering consolidation options such as master trusts to align with the push for scale.

- Engage with advisers to assess implications for decumulation defaults and productive investments, ensuring fiduciary duties are met amid potential mandation risks.

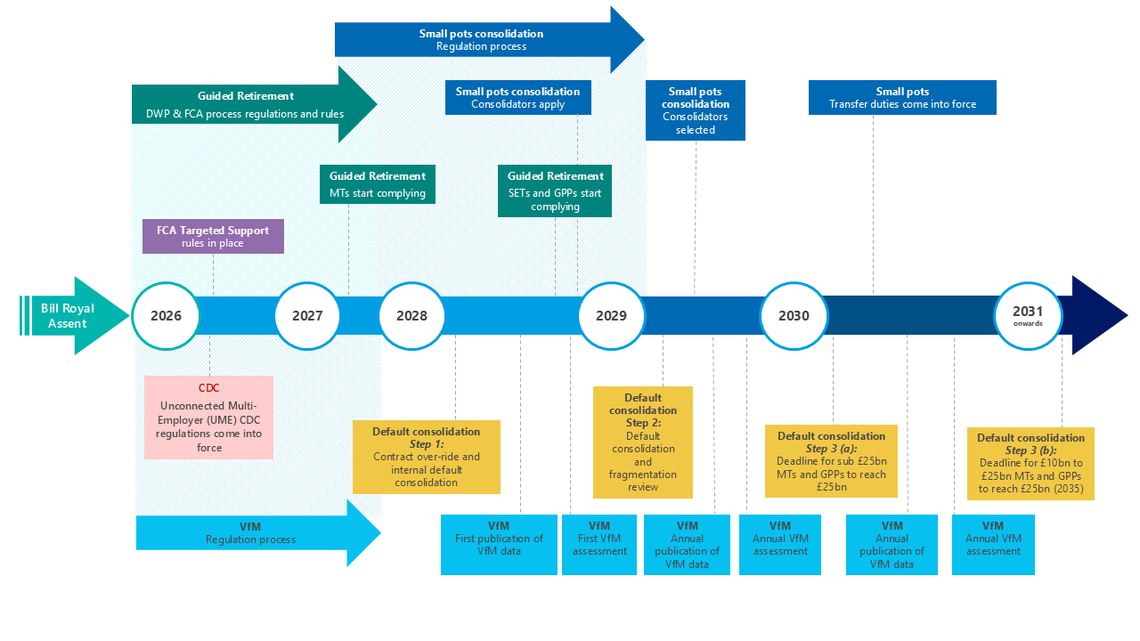

Following is our interpretation of the Pension Schemes Bill roadmap. Timings are very much indicative and subject to Parliamentary time where required.

Inheritance Tax (IHT) changes confirmed for April 2027

In the Autumn Budget 2024, the Government announced that from 6 April 2027, most unused pension funds and death benefits will be included in a person's estate for Inheritance Tax purposes. A technical consultation on the implementation process ran from 30 October 2024 to 22 January 2025, and the outcome was published on 22 July 2025.

Currently, pension funds and insured death benefits are generally excluded from IHT but, from 6 April 2027 these will be included in the value of an individual's estate for IHT purposes. Unused pension funds and death benefits will be subject to IHT if the estate exceeds the nil-rate band (typically £325,000, with potential increases for property and spouse exemptions).

However, following significant push back from the industry and interested bodies such as Group Risk Development (GRiD), death-in-service benefits from registered pension schemes - such as group life assurance - will remain excluded from IHT calculations. Also excluded are dependants' scheme pensions from defined benefit (DB) or collective money purchase arrangements.

In another significant shift following the consultation, personal representatives (e.g. executors) rather than pension scheme administrators will be reponsible for reporting and paying any IHT due on these pension-related assets.

Following HMRC's confirmation of the treatment of death-in-service benefits, employers should take the opportunity to review their arrangements to ensure they remain appropriate, especially where registered and excepted arrangements are in place.

Revised UK Stewardship Code

Following its 2024 consultation, the Financial Reporting Council (FRC) updated the UK Stewardship Code in April 2025. Published on 3 June 2025, the UK Stewardship Code 2026 replaces the 2020 version, effective from 1 January 2026, with a transition year for signatories.

The updated Code, along with draft guidance, significantly raises the bar for effective stewardship, demanding that signatories move beyond policy statements to demonstrate the tangible, real-world outcomes of their engagement and voting activities.

The revised Code’s primary focus is on impact. Signatories, including asset managers, will need to provide clear evidence of how their stewardship activities have contributed to long-term value for pension scheme members. There is a stronger expectation for reporting on how systemic risks, such as climate change and biodiversity loss, are being addressed through stewardship.

Key changes include more rigorous requirements to report on the rationale for voting decisions, the escalation tactics used when engagement is unsuccessful, and the results of collaborative initiatives with other investors. This shift from "process" to "outcomes" means trustees can expect, and should demand, more meaningful reporting from their asset managers. It aligns with parallel initiatives, such as Pensions UK's (formerly PLSA) updated Vote Reporting Template, which also aim to enhance transparency. For trustees, this provides a better toolkit to hold their managers to account.

For DC schemes, delivering stewardship-focused engagement requires trustees to scrutinise their default managers’ signatory status and performance under the new code. The broader reach of the code means non listed assets—such as infrastructure and private credit—must also be subject to stewardship policies. Failure to align could undermine governance and limit schemes’ ability to influence investee behaviour.

Actions for trustees:

- Review your scheme’s policies on voting, stewardship, and engagement within the Statement of Investment Principles (SIP) to ensure they reflect the heightened expectations of the new Code.

- Engage with your asset managers to understand how their reporting and practices are being updated to comply.

- Prepare to ask more challenging questions focused on the specific outcomes and impact of your managers’ stewardship efforts.

TPR’s push for innovation

The Pensions Regulator (TPR) is actively encouraging the industry to develop innovative solutions to improve member outcomes, particularly for at-retirement support. As part of its strategic vision for 2025, TPR has confirmed it is establishing an ‘Innovation Hub’. This marks a significant shift towards a more collaborative and forward-thinking regulatory approach, designed to help the industry address long-standing challenges. Themes include digital engagement tools, personalised retirement projections and adjusted default glidepaths responsive to member cohorts.

In May 2025, TPR launched an Innovation Support Service, including discussion sessions, collaborative events. This builds on TPR's February 2025 vision to implement a more prudential style of regulation, addressing risks at both individual scheme and market-wide levels. TPR's Chief Executive, Nausicaa Delfas, has outlined how the regulator will help boost economic growth by reducing regulatory burdens and enabling access to a broader range of diverse assets. A June 2025 hackathon and calls for asset managers to develop innovative products underscore the focus on long-term value.

The initiative to establish an Innovation Hub aims to provide a "safe space" where pension schemes, providers, and advisers can engage with the regulator to discuss new products, services, and member support models without fear of immediate regulatory censure. This move is a direct response to the government's call for a more dynamic DC market and acknowledges that the current regulatory framework can sometimes be a barrier to progress. The Innovation Hub is intended to facilitate the development of new decumulation products, digital engagement tools, and simplified advice models that can help close the advice gap and better support members in making complex financial decisions.

Actions for trustees:

- Engage proactively with TPR's Innovation Hub initiatives and consider how your scheme might benefit from new regulatory approaches.

- Review your scheme's data management capabilities and ensure digital readiness, particularly for Pensions Dashboards connectivity.

- Consider how innovation in areas such as member engagement, investment options, and administrative efficiency could improve member outcomes.

Quick updates

- On 7 July 2025, TPR announced a working group to develop a voluntary net zero transition plan template for occupational schemes, building on the UK Transition Plan Taskforce's framework. This follows the government's 25 June 2025 consultation on climate-related transition plans for financial institutions, which includes pension schemes.

- Action: Trustees should monitor TPR's transition plan working group outcomes, expected later in 2025, and pilot the voluntary template to assess their scheme's climate risk exposure.

- Over the last quarter pension dashboards connectivity has made significant progress. On 17 April 2025, the Pensions Dashboards Programme (PDP) announced that Legal and General had become the first pension provider to successfully connect to the pensions dashboards ecosystem in line with DWP connection guidance. This was an important milestone in the connectivity programme that will eventually see around 3,000 ‘in scope’ providers and schemes be accessible via dashboards.

- Action: Trustees should ensure they have a delivery plan for dashboards connectivity, which should be reviewed regularly in conjunction with their administrators, advisers and other stakeholders.

Workplace DC risk management

TPR remains concerned that some employers are continuing to make errors related to contributions in DC schemes. These include using incorrect earnings thresholds, errors in communications to staff and miscalculating contributions for staff receiving maternity pay.

These mistakes can lead to:

- financial loss for members;

- reputational risk; and

- increased scrutiny from The Pensions Regulator and HMRC, potentially resulting in financial penalties for employers.

Over the last year we have seen an increase in the number of errors being identified, some of which backdate 10 years or more. These errors can be complex and costly for employers to rectify. Also, employers’ automatic enrolment duties are complex and wide ranging.

The Pension Schemes Bill could help to address this issue by bringing many pension members into more modern, better run schemes with improved administration processes and oversight. The Bill includes proposals to:

- encourage small own trust schemes to move to larger, more modern pension arrangements; and

- enable bulk transfers without member consent for contract-based schemes, which may encourage employers to consider moving to more up to date arrangements.

Action: Employers should work with payroll, scheme administrators and DC pension advisers to review contribution processes on an ongoing basis, to ensure continued compliance. This shouldn’t be viewed as a one-off exercise and is particularly important where employer resources change, new pension arrangements are set up, corporate transactions take place, or on the introduction of salary sacrifice. It may also be prudent to conduct an in-depth audit if there are identified errors or areas of specific concern.

Latest Retirement Living Standards

The Retirement Living Standards (RLS), developed by Pensions UK and based on independent research by Loughborough University, provide a framework for understanding the cost of different lifestyles in retirement.

The standards are based on public consensus, outlining what individuals need to spend to live at what are referred to as Minimum, Moderate, and Comfortable levels in retirement. These standards are regularly updated to reflect changes in costs and public expectations.

The most recent update was issued on 3 June 2025 and include a decrease in the Minimum standard and modest increases in Moderate and Comfortable standards. The terminology has also been updated to use "one-person" and "two-person" households instead of "single" and "couple".

The cost of the Minimum standard for a two-person household has decreased to £21,600 per year (2024: £22,400), and for a one-person household to £13,400 (2024: £14,400). These decreases in the Minimum standard are largely attributed to a substantial reduction in energy costs and small adjustments to spending habits observed in research.

Moderate and Comfortable Standards have seen modest increases due to the impact of inflation across various spending categories, which have only been partially offset by lower energy costs.

This year’s update also brings a change in how living arrangements are described in the Standards. RLS now uses "one-person" and "two-person" households instead of "single" and "couple" to reflect a broader range of living arrangements beyond romantic partnerships. This change recognises that many people live together to share housing and living costs so it was felt the descriptions should reflect this subtlety.

Zoe Alexander, Director of Policy and Advocacy at the Pensions UK, said;

"We're not just seeing changes in costs, we're seeing changes in how retirees live. Retirement isn't a one-size-fits-all experience. The Standards recognise that retirees can share costs, often with a partner, and that can make a huge difference to affordability in later life."

Action: Employers and trustees should consider supporting employees with understanding income in retirement. This could include signposting tools and calculators that help with forecasting, consolidation and budgeting.

Pensions UK: the new name of the Pension and Lifetime Savings Association

The Pensions and Lifetime Savings Association (PLSA) has rebranded to Pensions UK. Julien Mund, CEO said this had been done to better reflect the evolving pensions landscape and its new, more focused strategy. The rebrand includes a new logo and visual identity, but the core mission to help people achieve a better income in retirement remains.

This change is part of a broader effort to align with the sector's shift towards consolidation, growth investment, and increased focus on retirement savings, much of which is being driven by government and regulatory pressure.

The rebrand is driven by a new ten-year strategy that aims to prepare the industry for the future, with a focus on key areas like consolidation, investment in growth, member engagement and how pension savings are used before and during retirement.

Targeted support proposals

On 30 June 2025, the FCA launched a consultation on ‘targeted support’ proposals which would apply to pensions and investments. The proposals are designed to address the ‘advice gap’, where research indicates not enough savers are seeking regulated financial advice, often due to accessibility or affordability concerns. Additionally, existing guidance services are not able to provide strong enough support to improve member outcomes as firms, individuals or trustees are fearful of pushing the boundaries of support into what might be construed as providing regulated advice.

This is the case even though savers are now being asked to make more complicated decisions in relation to their retirement and finances following industry developments such as the shift from DB to DC pensions, the introduction of Pension Freedoms and regular periods of economic volatility. The FCA has also expressed concerns about evolving trends in how individuals access advice on pensions and investments, including through family, friends and, increasingly for younger people, through social media.

We saw plenty of evidence of the concerns people have in planning for and moving into retirement in our report, The At Retirement Reckoning, which we published last year. For example, 41% of workers are not confident that they will be able to retire with a comfortable income.

DWP's CDC push: Autumn launch for multi-employer schemes

Following consultation last year, the DWP has announced plans to legislate for unconnected multi-employer collective defined contribution (CDC) schemes in autumn 2025. It intends, subject to Parliamentary approval, to bring the legislation and an updated TPR CDC module into force as soon as practicable. In addition, the Government says it will continue to work with industry stakeholders to develop decumulation only CDC schemes.

Currently, CDC schemes are limited to single or connected employers. The proposed legislation will extend the CDC framework to include multi-employer schemes where employers are not linked, allowing a wider range of employers and employees to benefit from this type of pension arrangement.

The DWP has already consulted on draft legislation to support this expansion and aims to introduce the new regulations in the autumn. The legislation will also address how these schemes will be authorised and supervised by The Pensions Regulator (TPR).

Action: If the Pension Schemes Bill gets enacted as drafted, DC trustees will need to assess for the first time which options will be most appropriate for their members. However, whilst the bill's enactment is anticipated in 2026, the actual implementation of its various measures will be a phased process extending over several years.

Recent BW publications

- Annual review of DC default strategies: In April 2025, BW completed its fourth annual review of the performance and trends amongst DC default investment strategies, with the latest research covering 25 default arrangements governed by DC workplace pension providers. These arrangements capture more than £500bn and over 43 million members.

- Large DC Schemes analysis 2025: In June 2025, BW produced its fifth annual report analysing large DC Schemes, with the latest research using anonymised data from nine leading DC providers, covering 122 large DC schemes (or large DC sections within a master trust) with combined assets under management (AUM) of just over £157bn. This year’s report has also gone further to consider not just scheme structure, pricing and investment characteristics, but also member engagement and retirement behaviours.

- Sustainable investment in 2024: In June 2025, BW published its fourth annual review of the sustainability of default investment strategies from DC pension providers - looking back at 2024 - in full. The research highlights the need for DC pension providers to be transparent about how they’re addressing climate change, as overshooting the 1.5°C goal becomes increasingly likely. It breaks down what this means for your members and the critical questions you should be asking now.

- Redefining retirement: investing for to:morrow: In May 2025, BW published a briefing on how poor outcomes for those approaching and transitioning into retirement can be overcome. The article introduces to:morrow, a solution for retirement income planning, combining digital technology, personalisation, and income-focused investment strategies to support better outcomes in decumulation.